japan corporate tax rate kpmg

5 rows 73 51 73 53 Over JPY 8 million. For comparison Singapores carbon tax comes in at an introductory rate of S5 RM1538tCOe until 2023 while Japans tiered carbon tax starts at 289 RM1081tCOe.

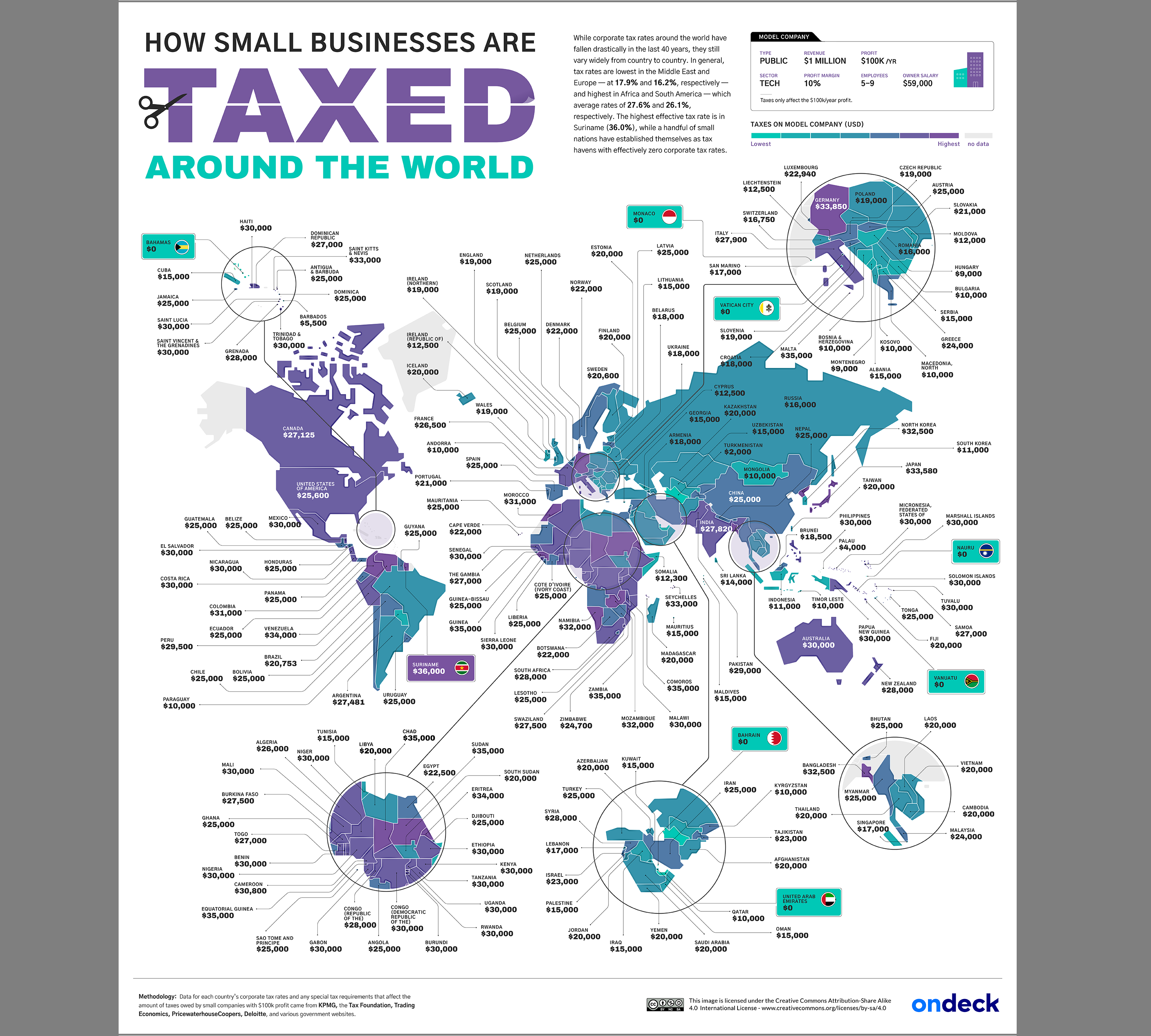

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

KPMG Japan Tax Newsletter.

. Corporate and international tax proposals in tax reform package 19 December 2018. 025 of capital plus capital surplus 25 of income x 14. Corporate tax rates table.

14 14 Taxable Year of Companies. This paper explores how corporate income tax reform can help Japan increase investment and boost potential growth. 81 3 6229 8000 fax.

In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. I added value component tax rate. Japan Tax Update PwC 3 Enterprise tax- Non size based taxation Standard rate April 1 2016 April 1 2018 October 1 2019 Corporate Tax.

Use our interactive Tax rates tool to compare tax rates by country or region. Local corporation tax applies at. Principal international tax kpmg us.

While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax. 2021 Global Withholding Taxes. Local management is not required.

Japan corporate tax rate kpmg. The corporation tax is imposed on taxable income of a company at the following tax rates. 15 15 Taxable Income.

KPMGs corporate tax table provides a view of corporate tax rates around the world. Some countries also have lower rates of corporation tax for smaller companies. Tax Rate Applicable to fiscal years beginning before 1 April 2015 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

Local corporation tax applies at 44 percent on the corporation tax payable. 16 Japanese Companies. Today most European countries have rates.

Donation made to designated public purpose companies. OECD average is 249. Local management is not required.

Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. KPMGs corporate tax table provides a view of corporate tax rates around the world. Effective Statutory Corporate Income Tax Rate.

Enhance corporate reorganizations and contribute to the maintenance and strengthening of international competitiveness of Japanese companies and. Corporation tax is payable at 255 percent. Note that the definition of capital surplus was amended by the 2020 Tax Reform Act from the tax law purpose to.

Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP for 180 separate tax. Amendments to Statute of Limitations for Reassessments or. Items to be described in invoices a Name of the supplier b Date of the taxable supplies c Description of the taxable supplies if they are subject to the reduced tax rate a statement to clarify that fact.

Per capita tax levied in a year is 4000. Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer. Reduction in Special Rate of Interest TaxInterest on Refunded Tax 20 2.

0375 of capital plus capital surplus 625 of income x 12. Corporation tax is payable at 239 percent. KPMG Tax Corporations strength is its ability to offer services for a broad range of clients tax needs.

The tax rate information on this page was last updated in January 2021 and the below historical tax rate data is available for. Using international and Japan-specific empirical estimates of corporate tax elasticities investment is predicted to expand by. Welcome to the KPMG knowledge base of research.

81 3 6229 8000 fax. Corporate tax rate in japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Tax base Small and medium- sized companies1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 152 232 Taxable income in excess of JPY8 million 232.

KPMG in Japan was established when KPMG opened a network office in 1954. Principal International Tax KPMG US. Tax Rate Applicable to fiscal years beginning between 1 April 2015 and 31 March 2016 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

KPMGs corporate tax table provides a view of corporate tax rates around the world. KPMGs corporate tax table provides a view of corporate tax rates around the world. Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021.

Taxation in Japan 2019. Special local corporate tax rate is 1526 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. 96 67 96 70 Local corporate special tax.

Since then the tax practice has strived to continually provide our clients with consistent high quality service that combines among the best of. Contact KPMGs Federal Tax Legislative and Regulatory Services Group at 1 2025334366 1801 K Street NW Washington. Changes to the controlled foreign corporation CFC regime considering the corporate tax rate reduction in the United States.

Outline Of The 2021 Tax Reform Proposals Kpmg Japan

Tax Leaders Priorities In Uncertain Times Kpmg Global

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

India S Big Bang Moment Brink Conversations And Insights On Global Business

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Net Zero Readiness Index Japan Kpmg Global

Outline Of The 2022 Tax Reform Proposals Kpmg Japan

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Is Us Highest Taxed Country As Trump Claims

World S Highest Effective Personal Tax Rates

World S Highest Effective Personal Tax Rates

Ceo Outlook Pulse Survey Insights For Tax Leaders Kpmg Global

Lowest Corporate Taxes In The World

The Average Corporate Tax Rates In Every Country In The World Digital Information World